refinance transfer taxes maryland

Man sitting on the floor at home reading on his laptop about the STAR program and New York property taxes. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based.

Smart Faq About The Dc Transfer And Recordation Tax Smart Settlements

The Maryland Homeowner Assistance Fund opened to homeowners statewideon December 20 2021.

. Your average tax rate is 1198 and your marginal tax rate is 22. -Each county has its own fees for what it charges on a Maryland home purchase for state recordation and county transfer taxes at settlement see below. It is typical to split all the.

-The buyer is exempt from the state transfer tax if they are a first-time homebuyer in the state of Maryland. Repayment refinance transfer sale. VA streamline refinance.

A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. The Loan term is the period of time during which a loan must be repaid. -The state transfer tax is always the same.

At Bankrate we strive to help you make smarter financial. Property tax relief for New York homeowners Image. Getting a mortgage with a lower interest rate is one of the best reasons to refinance.

True to its name this program also known as the Interest Rate Reduction Refinance Loan IRRRL pronounced earl involves little paperwork. For example a 30-year fixed-rate loan has a term of 30 years. For property taxes to be an eligible cost under the MD HAF Grant the following criteria must be met.

The program will continue. The average 15-year fixed refinance APR is 5450 according to Bankrates latest survey of the nations largest refinance lenders. Woman sitting at table at home wondering if social security benefits are taxable.

When interest rates drop consider refinancing to shorten the term of your mortgage and pay significantly. This marginal tax rate means that. Check the IRS website for the latest information about income taxes and your state tax website for state-specific information.

If you make 70000 a year living in the region of Maryland USA you will be taxed 11612.

Bluerock Homes Trust Inc Initial General Form For Registration Of A Class Of Securities Pursuant To Section 12 B 10 12b

Smart Faq About The Dc Transfer And Recordation Tax Smart Settlements

Bluerock Homes Trust Inc Initial General Form For Registration Of A Class Of Securities Pursuant To Section 12 B 10 12b

Smart Faq About The Dc Transfer And Recordation Tax Smart Settlements

Escrow Reserve Payment Real Estate Taxes Explained

California S Energy Policy Shows Us What Not To Do

Best Car Insurance Companies Of September 2022 Forbes Advisor

Another State Ditches Its Death Tax While Potential Backdoor Federal Estate Tax Looms

Columbia Care Inc Form 10 12g Filed 2021 06 16

U S Bureaucrats Are An Impediment To Pandemic Recovery

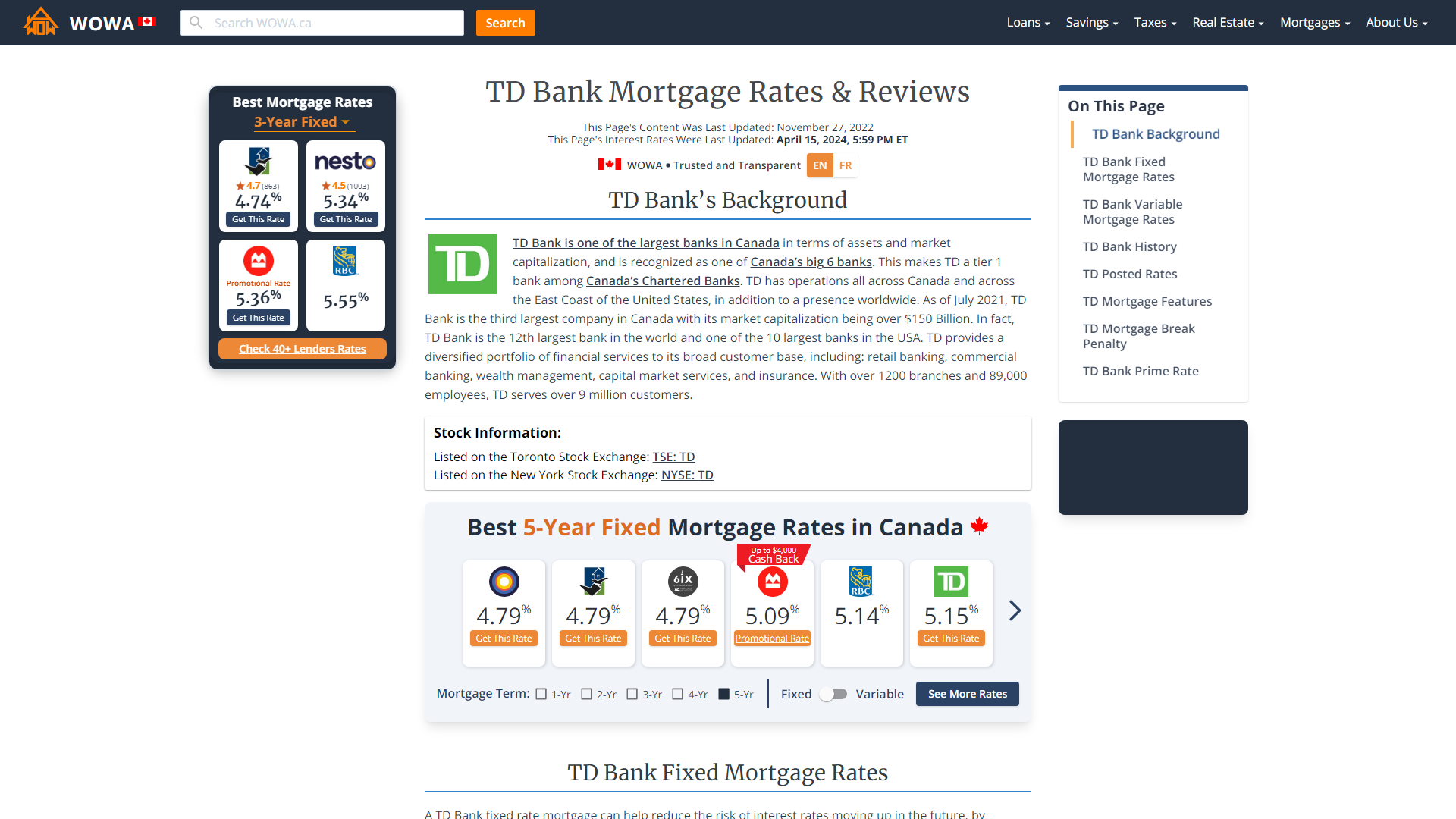

Td Bank Fixed And Variable Mortgage Rates Sep 2022 Special 2 74 Wowa Ca

Smart Faq About The Dc Transfer And Recordation Tax Smart Settlements

Negotiating A House Buyout At Divorce Divorcenet